The size, value, and profitability premiums are also similar for high- and low-debt countries. While average equity premiums have been higher for the high-debt group, the average differences have not been statistically reliable, as evidenced by t-statistics well below 2. The table shows little evidence that debt levels are useful for predicting equity market performance. Exhibit 2 displays results for these groups, formed annually within developed and emerging markets, with average annual returns computed for equity premiums as well as the size, value, and profitability premiums. One way to assess whether government debt levels contain meaningful information about equity market performance is to compare average returns of countries sorted into high- and low-debt groups. Therefore, it is ultimately an empirical question whether market returns are strongly correlated with country debt. Market participants can have well-formed expectations about future debt levels and effects on publicly traded securities, expectations that should be reflected in current market prices. 6įinally, country debt is generally a slow-moving variable. Ivory Coast defaulted in January 2011, 5 when its 2010 debt/GDP was just 46%. Argentina provided a recent example: Debt/GDP of only 90% 4 in 2019 was followed by a default in the first half of 2020. 3 Conversely, we have seen instances of countries defaulting on their debt at debt/GDP ratios lower than where many countries stand today.

Japan, for example, has experienced over a decade of debt/GDP levels above 200% without a default. The history of sovereign defaults suggests ballooning country debt is an ingredient, but one of many variables contributing to the cause. Moreover, economic theory does not offer a debt threshold beyond which a country is in economic peril. An important point for investors is the uncertainty regarding which component should dominate and the time horizon over which these effects appear. These theoretical arguments can be distilled down to impacts felt through company cash flows-in the case of the higher borrowing cost or lower private spending arguments-or through discount rate effects, such as the consumption volatility story. Gomes and Michaelides (2008) suggest the greater supply of riskless assets, such as government debt securities, could lead to households investing less of their net worth in risky assets, lowering their consumption volatility and, in turn, the equity premium. Becker and Ivashina (2018) argue that government debt instruments could compete with those of corporations in the financial markets, crowding out lending that would otherwise go toward corporations. Higher borrowing costs and/or lower private spending could compromise the ability of corporations to generate future cash flows. But, while government spending may provide a short-term stimulatory effect on the economy, the prospect of higher future taxes and long-run impacts on spending and investment introduces many channels through which spending and debt levels might affect expected stock returns.Īcademic arguments supporting a theoretical relation between government debt and stock returns include one described by Blanchard (1991) whereby debt-financed government spending may raise interest rates and/or crowd out private spending. What's new in this version: - First of all, it was on Linux only, so I've adapted it to Windows.The intent behind much of recent government spending was to mitigate the economic impact of the COVID-19 pandemic. You don't need any technical experience at all to get the most out of it.

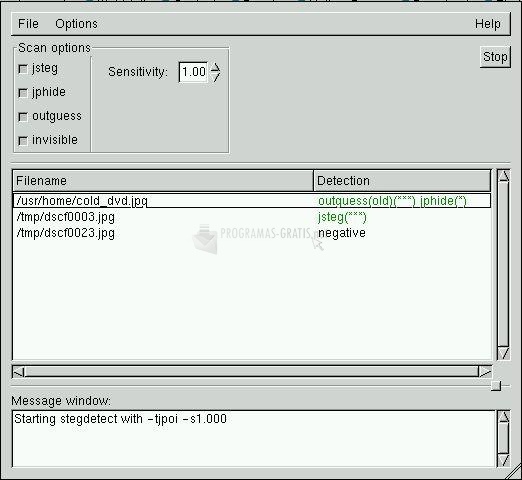

Outguess pc install#

This encryption program is very easy to download, install and then use, through its friendly and intuitive user interface.

The program makes it easy to embed hidden data anywhere on the Internet, from a blog to a photo sharing site like Tumblr, Flickr, Google+.

Outguess pc software#

The software interface is very simple interface for the steganography novice. Outguess-Rebirth use the Outguess steganography engine, this reduces the chances of anything hidden being detected by specialists tools or forensic expert.

Outguess pc free#

Outguess-Rebirth is 100% free and suitable for highly sensitive data covert transmission.īefore hiding data everything is securely encrypted with AES, scrambled, whitened and encoded.

Outguess pc portable#

" Outguess-Rebirth is a portable steganography" Outguess-Rebirth is a portable steganography tool for Windows, allows a user to embed hidden data inside a image JPEG.

0 kommentar(er)

0 kommentar(er)